Once again Mohnish Pabrai, our favorite value investor, has released a great market beating portfolio. It’s a ‘set it and forget it’ style portfolio just like The other two he has released to us:

This time he sets his sights on the world of spinoffs, putting together a portfolio of Five Stocks that meet very specific guidelines. He first released this idea in November of 2017 on Forbes, and on his personal website;

Chai with Pabrai, (which you should immediately add to your favorites list).

Mohnish Pabrai

There are probably many of you who have never heard of the man named Mohnish Pabrai, that is unless you’ve engrained yourself in the world of value investing, and that’s exactly who Mohnish Pabrai is (amongst other things). He’s a Value Investor, and an excellent one at that. He’s been compounding his investors money at an average of over 20% per year, since his funds inception in 1999. Over the last year alone he is up more than 50%. This is just one of the reasons why we should take his ideas seriously.

He’s also an amazing author and philanthropist. His book The Dhandho Investor, is among my top 5 favorite investing books of all time, and should be on every serious investors bookshelf. He and his wife started an Indian non-profit, The Dakshana Foundation, to help intelligent impoverished students prepare for IIT (India Institute of Technology) and medical entrance exams. It’s a really great concept, and is growing rapidly. They currently have seven campuses throughout India to serve this purpose.

What is a Spinoff?

A Spinoff is when a company ‘spins off’ a business unit (chunk of the overall company) into its own separate public company. The shareholders get a piece of this new company. The objective of a spinoff is to create a win win for the shareholders and the business, by allowing the core business to rid itself of a non-core entity and allowing the spun-off company to flourish by focusing on what it does best.

An example of this was when automotive conglomerate Fiat Motor Company (FCAU) spun-off one of its businesses; Ferrari. They did this for two main reasons:

They believed it would unlock shareholder value for the current FCAU shareholders.

They believed that Ferrari would perform better as its own entity. (which it now is listed under the ticker symbol: RACE)

They compensated the shareholders by giving them 1 new share of RACE for every 10 shares they owned of FCAU. So, if you owned 1000 shares of FCAU, you would have been given 100 shares of RACE. You could then instantly turn and sell those shares at the market price on January 4th 2016. The price was a round $40 a share at the time giving the new owner an instant $4,000 (or a roughly instant 40% return). If you decided to simply keep your RACE shares you would have done even better, with their shares trading at a price of $121, or a 3X return from the Spinoff price.

Though they don’t always work out this well, this is how powerful an ideal Spinoff can be. It unlocks potential for both the underlying entity, and for the shareholders. This is the underlying basis for what Mohnish Pabrai calls his Spinoffs Portfolio.

Spinoff Performance

Back in the 90’s (1997 to be exact) Joel Greenblatt published his amazing book; You Can Be a Stock Market Genius, considered the best book ever written on the topic of Spinoffs. In this book, Greenblatt explains why spinoffs beat the overall market. In fact, he cites a study made back in 1964 to 1988 where spinoffs managed to absolutely destroy the market by a whopping 10% per year on average over that 22 year period.

The problem most shareholders have is that they tend to sell off the new shares they recieve after the spinoff takes place, getting that instant gratification style return, instead of holding the spun-off company. As you can see from the example above, it would have been much more beneficial for the shareholders to have just held onto the RACE stock they received instead of quickly turning that 40% profit they would have today over 120% gain.

This is doubly true with regards to institutional investors because they are often forced to sell the spun-off company (if it’s below a certain market cap) or they don’t understand the spun out business. This action usually immediately drives down the price of the spinoff for the first few quarters, usually making it a good time to invest right after this occurs.

The question remains;

Do Spinoff’s Still Outperform?

Pabrai and his Quant friend Velicherla decided to do some backtesting on Spinoffs to see if they still outperform the market on a regular basis. They did this by setting up a 5 stock portfolio of Spinoff’s, using these specific Rules:

Spinoffs tend to perform at their best between the 1st and 7th year.

The spinoff needs to be completely independent from the parent company. They only pick the spinoffs with 70% (or more) of the shares floated in the stock market.

They use an algorithm that selects the five youngest spinoffs each year.

The portfolio resets every year; the old companies that are not present in the new portfolio are removed and replaced while the ones that are still present are simply held for another year (without adding or subtracting any shares).

You can find the Full list of which five stocks were in the portfolio from 2000 to 2017 on the original Forbes article.

Spinoff Portfolio Vs S&P 500 Performance

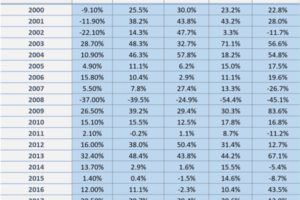

Here’s how the portfolio performed compared to the S&P 500 from the year 2000 to 2017(historically poor performance time frame).

Over the last 17 years, the Spinoff managed to outperform the S&P 500 by 7.9% per year on average. In other words, If you started with a $12,000 portfolio and managed to save $1,000 a month, and added that $12,000 at the end of every year to your Spinoff portfolio, the portfolio would now be worth a respectable $644,868.72. Vs the S&P 500 portfolio performance of $321,125.53.

Side Note: Its important to take notice of the volatility that takes place in the Spinoff Portfolio Vs the S&P 500. If you compare the two, side by side you see that to have invested in the Spinoffs over the last 17 years would not have been for the faint of heart. You would have had to endure some very difficult down years while being sure to follow the rules, year in and year out. It’s extremely important that if you invest in a strategy like this that you understand what you’re getting into and that you keep following the rules for the Long-Term (10+ years). It can just as easily underperform over short-term periods as it can over-perform. You must be able to stick with it.

Here’s the Spinoff Portfolio for 2018

Adient plc (ADNT)

CSRA (CSRA)

GCP Applied Technologies (GCP)

Lamb Weston Holdings (LW)

Synchrony Financial (SYF)

You can go here for an updated list of all my favorite portfolio’s (one of my favorites has a 17 year return of 17.4%)

To learn more about two of the above companies; SYF and ADNT, check out Pabrai’s Forbes article

Full Spinoff Portfolio Rules

(As stated in the forbes article)

Selection Criteria:

Minimum market cap of $100 million

Price/Sales Ratio less than 3.

The twelve-month net income for all the years must be positive.

The free float of shares outstanding of the previous year must be 70% or greater.

The spinoff must have been spun-off for more than 1 year but less than 7 years.

If the spinoff company is currently less than Five years old, the company is only eligible to enter the portfolio if its parent company has a credit rating above or equal to BB+ by S&P or Fitch or EJR, or Ba1 by Moody’s. If the company doesn’t have a rating from any of the four rating agencies, it is also eligible to enter our portfolio. If the spinoff company is 5 years or older, the spinoff itself must meet the same credit rating criteria.

Select the most recent Five Spinoff companies.

Rebalance Methodology:

Rebalance on December 31st of each year. (if you’re in the US, sell the losers before the new year, hold the winners for a year and a day to decrease Capital Gains tax)

The old companies that are not in the new portfolio are sold. The “sell money” is accumulated and distributed equally among all new entrants.

If the same company is present in our portfolio, then we do not change the portfolio’s weighting in that company.

Other rules:

Dividends are reinvested into the same company that paid it.

If there is an involuntary removal through acquisition/delisting/bankruptcy, then the cash is distributed equally among the remaining companies in the portfolio.

If there are any Spinoffs (the grandkids!), the new spinoff company becomes a part of the portfolio.

A special thanks to Mohnish Pabrai and Jaya Bharath Velicherla for creating this portfolio and releasing it to the public.

Further Reading for you investing nerds...

For more awesome Pabrai Portfolios, Start here:

https://www.nextlevelinvesting.org/freelunchlist/

Or check out his great blog:

http://www.chaiwithpabrai.com/

PS.

Before you go, Sign-up to my newsletter and I’ll send you my Next Level Investing Checklist. Be sure to use it before you make any investment. No spam ever. Just post updates and Weekly interesting investing information.

Leave a Reply

Get in the Conversation, Share your opinion.