Where is the market today?

how long will this type of market last?

These questions are being asked more and more lately as we continue this trend. Here’s the thing, they are both undeniably interesting questions, and I’ll answer them, but they aren’t necessarily what we should be focusing on.

Our focus

The truth is, it doesn’t really matter where the total market is at any given time. Say what?! I know, but it doesn’t. What Matters is you follow your style of investing. In other words, you have a clear plan, and you keep following it. For me, that's trying to find excellent companies, and buying them when they’re on sale. Simple right? The rest is just noise, and can distract us from what we’re really trying to do here.

So, maybe what we should really be asking ourselves is ‘are my holdings over-valued?’ And ‘at what point should I sell?’ or ‘Are the companies I want to own, currently at a price I’d be happy to pay?’. That’s what’s really important here. In other words, we need a definite plan. But, that’s not all we need…

As I’ve talked about before, we are prone to human misjudgment; Letting our emotions get the best of us, which inevitably leads to failure... Do you remember our two systems of decision making? The Fast, but Crazy, The Slow, but Lazy? If not, you should start there. We need to know ourselves, to know what we’re vulnerable to. And right now, in the throes of an 8 year Bull market, I’d say we’re pretty darn vulnerable.

Here’s the thing, we’re really terrible emotional time travelers. It’s something Psychologists call an Empathy Gap. It’s our inability to predict our own future behaviour under emotional strain. This emotional strain occurs most often during two times:

1. High Euphoria

2. Fear and Panic

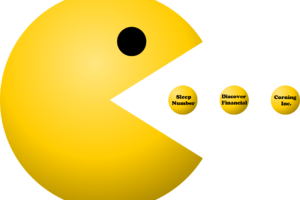

Here’s the thing, the stock market (aka Mr. Market, featured in the photo above) is a constant manic depression machine. What I mean is, it constantly and continuously puts our emotions into states of great euphoria, and hopefully less often, in states of fear and panic. It’s just the way Mr. Market is. It can’t help itself. Therefore, at any given time in the market, we’re likely unable to predict how we will feel in certain situations, and will be unable to control our emotions. Our fast, but crazy system is usually taking the lead, and as we’ve now learned, this will lead us to disaster. So what can we do?

What we can do

James Montier (writer of The Little Book of Behavioral Investing) says we must do three things to battle this. Something he calls the Three P’s of Investing. We must:

1. Prepare

2. Plan &

3. Pre-commit to our investing strategy

Montier says that ‘Perfect planning and preparation prevents piss poor performance’. Which not only sounds hilarious to me, but also quite rational. In other words, we should Prepare by doing our research while we’re in a cold, rational state (when the market isn’t doing much). Then, we need to Plan at what price we want to own the business, and at what price we want to sell. And most importantly, we must Pre-Commit to the analysis and follow our prepared plan.

So, to summarize: do your research. Set your buy point for the company you’d love to own. Buy it, when it reaches that point. Sell it when it reaches your sell point. Ignore everything else. Simple as that.

The Templeton way

We can follow in the footsteps of the legendary investor John Templeton, who was well known for saying “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” It’s difficult to disagree with this statement, but not following the wisdom in the words is a much easier.

The best thing about Mr. Market is that he always gives us opportunities, for both instances that Templeton refers to. He’s often ridiculously Euphoric, making the companies we own go well above their intrinsic value. At other times he’s severely depressed, allowing us to buy businesses we love, at fire sale prices. The truth is, he’s crazy, but if we can be patient, and follow the plan, we will love him for it.

John Templeton had a simple way of overcoming our Empathy Gap (found in Investing the Templeton Way). He would make his investment decisions, well before the sell-off occurred. He had a ‘wish list’ of businesses that he wanted to own, but they weren't at the prices he wanted to pay. He knew that for the businesses he wanted to go on sale, the market would have to be in a bad way. And when that happens, he knew it would be very difficult to be a buyer, when everyone else is yelling SELL! So, here’s what he did… Instead of waiting for the businesses to go on sale, he had standing orders with his broker, to purchase those companies once they reached, what he believed, was a bargain price. Taking the emotion out of it. Genius right?

Our way

The beauty of it is, we can do the same. Once we build a list of amazing companies that we’d love to own (our very own wish-list), we can start to figure out what price we want to own them at (if you don’t know how to do that yet, I recommend starting here). Then, if we’re really proactive about it, we can set limit-orders through our broker, at the price we’d be willing to own them at, for whatever duration period we choose.

Note: if you do this, you probably shouldn’t set the duration out too far. The company will change and grow, and so will your margin of safety price. The ideal way to go about this would be to adjust your margin of safety price every 3 months (in other words, after every earnings call), because that is when new information about the company usually arrives.

The opposite side of the equation would be to figure out what price we’re happy to sell something we own at. One rule of thumb i’ve come across is to sell whenever the company is selling 120% above our fair value calculation. So, once we have that figured out, we can do what Templeton does, and have a standing sell order for the business at the price we’re happy to sell it at.

Remember our goal is to eliminate our emotional biases as much as possible. Setting these buy and sell orders will accomplish that for us. Completely taking the emotion out of the ordeal.

The most important thing here is that we have fair value figured out. That’s the much more difficult prospect. That being said, using this post, should give you a great starting point. (Again, re-adjusting after every earnings call or other important company news). This will eliminate our empathy gap, and prevent us from getting caught up in the hysteria of the market. I’m pretty sure no one has ever gone broke selling winners.

The more active way of doing this is: have a wish list of companies you want to own, with the prices you’d be more than happy to own them at figured out, then continuously follow the companies. Once they fall to your margin of safety price (which they eventually will) you make sure to follow your plan, and buy them when they’re cheap. Simple as that. But, a little more active than the Templeton way, making us more vulnerable to our emotions.

The result

The best part is, if you’re able to buy these companies at ridiculously attractive prices, you’re likely to have subnormal returns over long periods of time. This will greatly increase your yearly compounded rate of return, and thus, make you a lot more money in the long run.

It may be true that you can’t time the market, but as value investors, we can absolutely time when we buy the businesses we want to own, at the prices we want to pay. Value changes everything.

The advanced way

The more advanced way to do this is with stock options.(close your eyes if that word scares you.) You can simply sell a put at the strike price you’re more than willing to own the business at. (don’t worry if you don’t understand a word of this, you will, it just takes time. And i’ll do everything I can to get you there) What selling put options allow you to do is buy a business you love, at a price you’re absolutely happy to own it at, and getting paid upfront to do so. It’s similar to setting your buy price with your broker, but instead, you get paid. In other words, if the company you want to own, falls below the price you sold the put option at, you get to own it at the price of the put. And we get to set that price. Kinda cool right. I know this is probably over a lot of your heads, I know it was waaay over my head initially, but options can be really powerful once you learn to properly utilize them. This is a big step up to becoming next level investors (if you want to learn more, just email me, and I’ll get back to you asap).

Alright, now that we know we must have a plan in place to fight our fear and our greed, and we know how to do so, let’s check and see a snapshot of the market today…

Continue on to part two:

Leave a Reply

Get in the Conversation, Share your opinion.